Economic Forecasts for 2014 – Clash of the Titans

Ros Altmann’s forecasts and speech at the Economic Research Council’s ‘Clash of the Titans’

event on 10 December 2013.

by Dr. Ros Altmann

(All material on this page is subject to copyright and must not be reproduced without the author’s permission.)

Economic Outlook for 2014 – A boom year!

I am forecasting that the economy in 2014 will be very strong. Indeed it could be quite a boom year. Having watched the leading indicators for some time, I believe the economy is set for much better growth than expected. Despite the strength of so many leading indicators, it seems that mainstream economic commentary and policy decisions are being influenced much more by lagging indicators, which reflect the weakness of the past, not the reality of the future. The leading indicators point to a broad upturn next year which I expect to be driven by rising investment, construction and confidence. Unemployment is likely to fall, albeit with a bit of a lag, as I will explain later. Given this economic strength, it seems clear to me that interest rates are currently at the wrong level and are encouraging people to take on debt that will be hard to service when rates eventually rise.

So I am actually predicting a bit of a boom for the economy leading up to the 2015 Election.

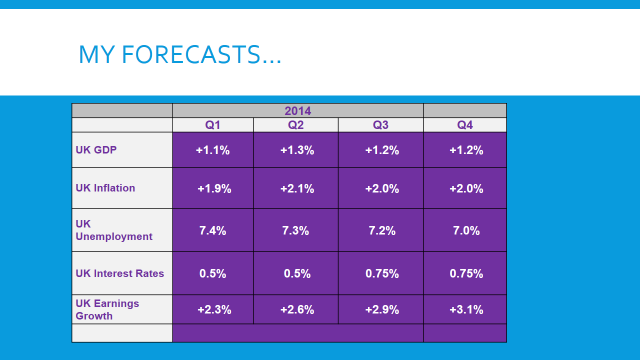

This is what I am calling a pre-election ‘boomlet’ – a strong period of growth through 2014 and into 2015. In Q1 2014 I predict 1.1% growth, in Q2 +1.3%, Q3 +1.2% and Q4 +1.2%, so the whole of 2014 would see a growth rate of more than 4.5%. There are many reasons for this. Indicators for construction are rising strongly and I expect investment to pick up sharply. This is because of pent-up demand, as companies have failed to invest in recent years and also because corporates have a record £200billion or more of cash in their balance sheet, so as the economy grows they are likely to commit to more investment plans at last. During 2014 I also expect earnings and employment will improve further. Despite this bullish view, I am also predicting that inflation could surprise on the downside, especially as the Government will try to keep inflation as low as possible.

So what evidence do I see that suggests growth will be so much stronger than expected?

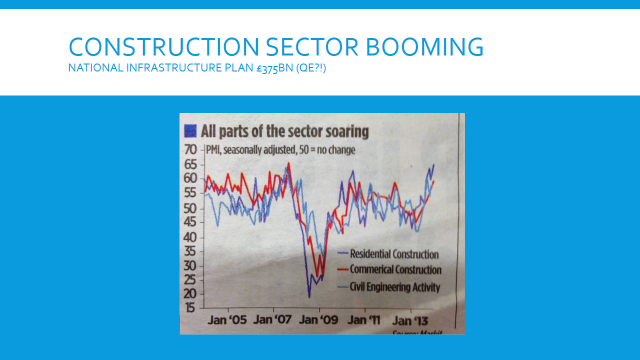

The recent PMI surveys are indicating the strongest growth for many years. Indeed, the October all-sector PMI was the highest on record (since 1998!) All the important sectors are now strong –

with services, manufacturing and construction at highs. The Chart (from Markit) shows the construction sector is soaring. Indeed, the leading indicators for building such as new orders for residential construction have reached their highest level since 2003, while the PMI employment index is at a record high. Even the US Conference Board indicators are positive –

the coincident indicators have reached 104.9 but the leading indicators are even stronger at 107. We seem to have become so used to pessimism on the economy that we find it hard to believe good news may be ahead. This has been holding back recovery to some extent I suspect, however I wonder if it is also possible that the outlook for the UK economy is being influenced not just by economics, but also by politics.

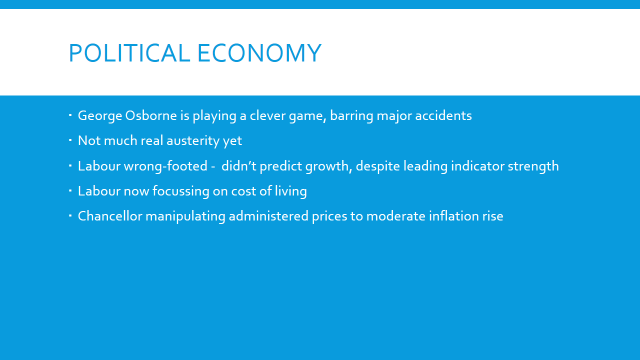

One might ask whether George Osborne, renowned political strategist, has been playing a very clever game with the economy. Of course, his plans could be blown off course by some major global accident or Eurozone crisis, but if you actually look at the figures, it seems that there has not been much real austerity yet –

the pace of cuts in reality has been much less than the rhetoric overall. By slowing public spending cuts and encouraging more borrowing by consumers, on top of the PPI compensation payouts, the economy has started to recover during 2013 and is being further bolstered by Funding for Lending and the emphasis on boosting the housing market. The economy is being driven by rising borrowing and the housing market, as well as Government consumption – and firms have been increasing stock levels as well.

This strategy has wrong-footed Labour, who completely failed to forecast the growth of the economy this year, despite the clear strength of the leading indicators that I have described. By over-playing the impact of austerity, which has really been relatively modest so far, and by failing to spot the signs of recovery, the Chancellor has managed to restore his economic credibility to some degree. The Tories know that housing and debt drives growth short term and, although that is not the best way to achieve a sustainable recovery, it is politically expedient.

Labour has now changed its attacks on Government policy to focus on the cost of living, but it could be that the Chancellor is one step ahead on this one too. There are already clear signs of official manipulation of administered prices for 2014, which I expect will moderate inflation.

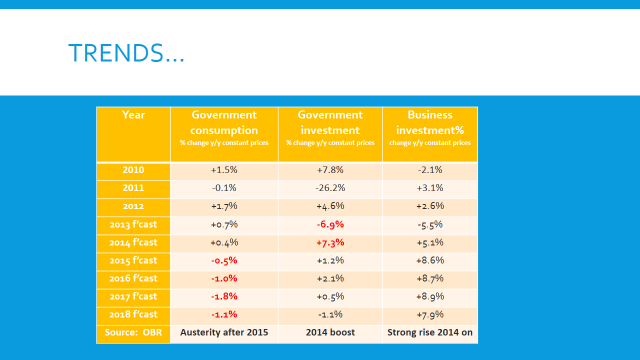

To further this theme of political planning, let’s look at some figures I have taken from the Autumn Statement documentation, showing trends in Government and Business spending and investment.

Firstly, looking at Government consumption since the Coalition came to power, it is clear that the austerity argument is quite weak. Government consumption (albeit some of this being cyclical) has been positive in constant price terms and is forecast to remain so until, surprise surprise, after the election. From 2015 onwards, Government consumption growth starts to fall.

Then looking at Government investment, it is clear that 2011 saw a dramatic drop with a recovery in 2012 (partly perhaps due to the base effect of such a sharp decline the previous year) but then another dip in 2013. This paves the way for an extra boost coming in 2014 –

with the Treasury ramping up public investment spending ahead of the election, just to ensure growth is timed helpfully.

Business investment was positive in 2011 and 2012, although it is expected to have fallen during 2013, but a good recovery in 2014 and beyond should add further strength to the economic outlook. Businesses have plenty of cash and will start to spend it as the economy picks up. I would expect some new tax incentives for this to happen to be introduced in the March Budget, if there are any doubts about the investment outlook, again to boost growth ahead of 2015.

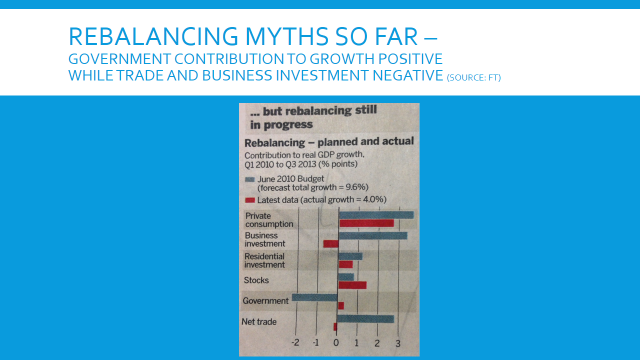

All in all, therefore, it seems that the 2010 predictions that the Coalition would ensure a much-needed rebalancing of the UK economy have turned out to be rather a myth, as shown in the following chart compiled by the Financial Times.

Rather than economic growth being led by trade and investment, amid the promised austerity, the overall growth rate has been far below the 2010 expectations, but what growth we have had has actually been driven by consumption and even Government spending, while the contributions from net trade and business investment have in fact been negative.

So the clearly required rebalancing is actually yet to come. What went wrong? Has this situation happened by accident, could it have been improved? If the Government had wanted to kick-start growth meaningfully much earlier, could it not have introduced the kinds of incentives that have now started to boost activity? Was there a deliberate delay to ensure growth was picking up for 2014, rather than risk an early growth pickup which then might be petering out by the time of the next Election?

By accident or by design, it seems the economy has been very conveniently timed to match the electoral cycle. As we get closer to 2015, the Chancellor is planning to boost investment sharply both by Government spending, as well as finally organising the National Infrastructure Plan. This will find £375billion to fund new infrastructure projects in coming years, starting in 2014 (I can’t help smiling at the coincidence that this figure is exactly the amount of new money created by the Bank of England under Quantitative Easing!) In addition to all this, the Chancellor is also planning to continue his reliance on housing to deliver a ‘feel-good’

factor and further growth. Mortgage lending was boosted this year by Funding for Lending and the Help to Buy scheme is still set to go ahead in 2014, despite continued warnings, even from the building sector itself, that this is creating a dangerous housing bubble that may be very painful when it bursts. So, for now, the required rebalancing of the UK economy seems firmly on hold, as the Chancellor tries to ensure growth by whatever means possible before 2015.

Now let me just turn to my specific forecasts for each of the individual variables that we have been asked to predict for the UK economy. Earnings growth.

In line with my expectations of stronger growth, I am forecasting rising earnings during 2014, with average earnings growing by around 3% by end-year. My forecasts for 2014 are that earnings will grow by 2.3% in the first quarter, picking up to 2.6% in Q2, 2.9% in Q3 and then 3.1% in Q4.

What will this mean for employment?

The trend in the unemployment rate is particularly hard to predict, partly because of the extent of under-employment which seems to exist at the moment. Many people are working part-time or less than full hours, so an initial response to rising economic activity could well be to utilise existing staff more fully, rather than rushing to take on new workers. In addition, with many more people staying at work past state pension age, there is likely to be a continued trend of rising employment translating less directly into falling unemployment figures than might otherwise be expected. However, the risk to my forecast may well be that the unemployment level falls faster than expected and I would anticipate unemployment may reach Mark Carney’s forward guidance objective level of 7% before the end of 2014 –

rather earlier than expected.

What about inflation? I am forecasting another positive surprise.

Given the strength of growth one would normally expected a pick-up in the inflation rate, however I detect signs that this may not be the case. There is already evidence that the Chancellor is manipulating the cost of living somewhat, by holding down energy price increases and rail fare rises, keeping a lid on council tax and perhaps other administered prices as well. In addition, there are strong deflationary forces elsewhere coming from Europe as well as from the 5% trade-weighted rise in sterling that we have seen during 2013. The base effect from this year is also likely to flatter the inflation figures for next year. I am predicting a lower inflation rate than is generally expected with Q1 being at 1.9% and then the rest of the year remaining at about the 2% target level.

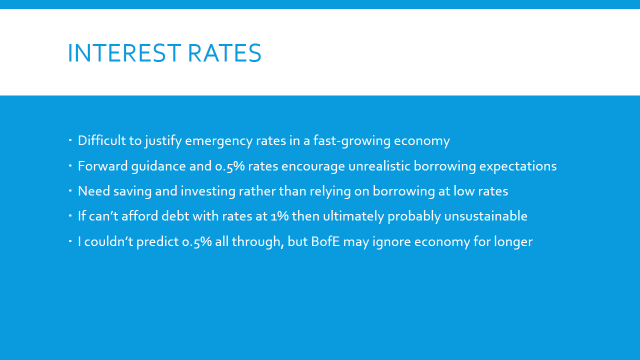

So what does all this mean for interest rates? Well, with fast growth you would normally expect rising rates, but if inflation remains subdued and unemployment responds to growth with somewhat longer lags than usual, there will be less pressure to increase base rate. However, looking at the current 0.5% rate, it is so difficult to justify retaining an emergency interest rate level when the economy is booming. I believe this is dangerous, but the Bank of England has made clear that it wants rates to stay low for several years. I remain seriously concerned that this will encourage many people to borrow at unrealistic rates, rather than saving and investing for the future.

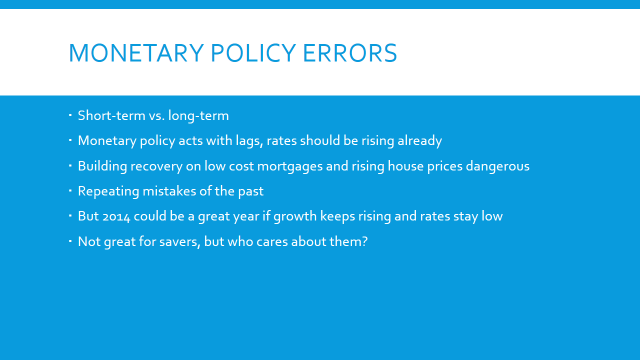

There are dire warnings that a rise in rates would lead to major problems for borrowers, defaults and repossessions, which would derail the economic recovery. I find those arguments difficult to accept. A small rise in rates from 0.5% is hardly likely to bring borrowers to their knees and would be a welcome sign of the start of a return to normality, giving also a sign of increased economic confidence. Let’s face it, if people could not afford to repay their debts with an increase in base rates from 0.5% to, say, 1%, then surely those debts are going to be defaulted on sooner or later and need to be rescheduled. Meanwhile, low rates also have negative effects on some parts of the economy, including pensions, annuities and savers. Despite forward guidance, I could not bring myself to predict that the Bank of England will really keep rates at such ludicrously low levels in the face of a strong economy, so I forecast that base rate will increase to 0.75% by third quarter 2014. This may be a triumph of hope over reality, but I do hope rates will start rising well before 2015. I have significant concerns that monetary policy is continuing to make major errors. By focussing exclusively on the short-term, the Bank of England seems to be missing the longer term dangers.

Normally, monetary policy operates with a lag, and in the face of the pace of growth we have already seen, one might have expected rates to have started rising already. However, it seems that the decision has been taken to build economic growth on the availability of cheap borrowing, low cost mortgages and rising house prices. Is this not repeating the mistakes that led to the original crisis but, for now, it is likely to be successful in stimulating growth short-term, which is clearly a policy objective. If I am right, then 2014 should be a good year for growth as well as for borrowers. It is also likely to be the first year for some time that sees real earnings rising. Of course, the ongoing low interest rates will be yet more bad news for savers, but who cares about them anyway?

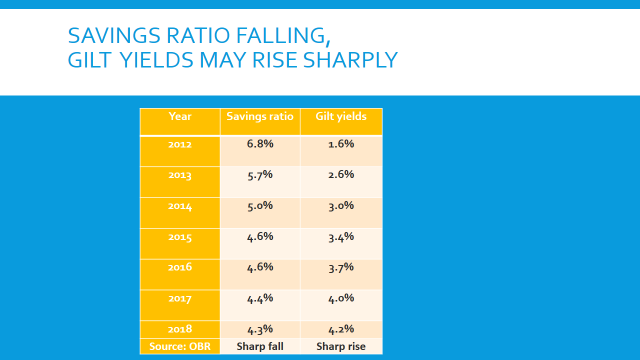

The Autumn Statement carried forecasts showing that the UK savings ratio is expected to fall sharply in the coming years. From 6.8% in 2012, the OBR suggests it will fall to 5% next year and 4.6% in 2015 and 2016, with a further fall to 4.3% in 2018. At the same time, gilt yields are forecast to rise strongly, from the amazing level of 1.6% reached in 2012, nearly doubling to 3.0% in 2014 and to 4.0% in 2017. This is still a very low level in comparison to recent history, but rising gilt yields are likely to mean rising short rates sooner or later.

So, in summary, my economic forecasts are for a boom year next year, with high growth, lower inflation, rising earnings and falling unemployment. The specific figures are as follows:

So I want to thank you for listening. I realise these forecasts are open to question, especially as the economy has been behaving in unusual ways in recent years. However the leading indicators are so strong it seems like the UK economy is booming, I expect the stock market will do well and that the economic news will be conveniently positive ahead of the election. Will I be right? We shall find out in due course. I’ll see you next year for the verdict.

Dr. Ros Altmann

blog: pensionsandsavings.com

website: www.rosaltmann.com

twitter: @rosaltmann

ENDS

Dr. Ros Altmann

28 December 2013