2014 – a Boom Year – electoral and economic cycle brilliantly aligned

Boom time for UK economy in 2014 – 5% growth

by Dr. Ros Altmann

(All material on this page is subject to copyright and must not be reproduced without the author’s permission.)

Positive surprises – higher growth, lower inflation, rising earnings, falling unemployment

Economic and political cycle brilliantly aligned –

by accident or design?.

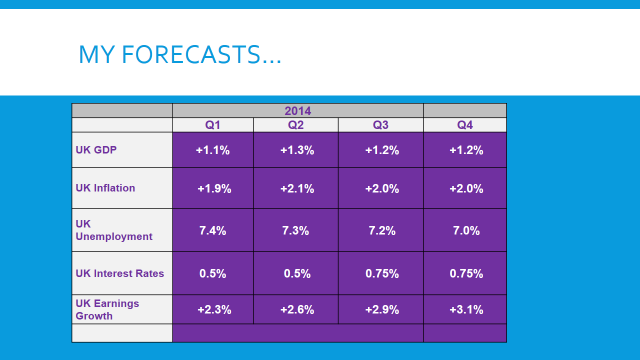

My forecasts for UK economy by end-2014

Growth – 5%

Inflation – 2%

Earnings growth – 3%

Unemployment – 7%

– a boom with low inflation, rising earnings and falling unemployment

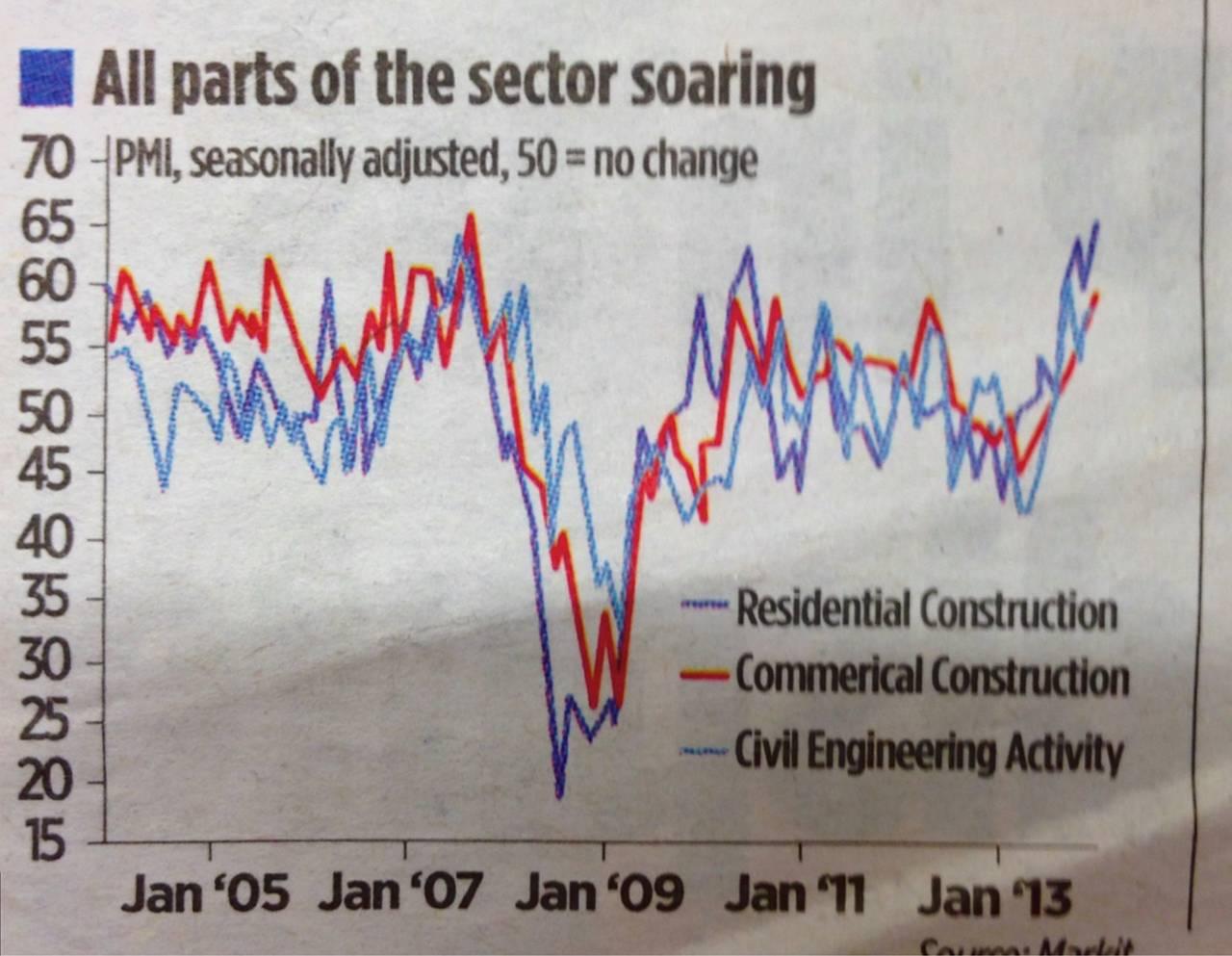

Leading indicators show UK set for a pre-election boom: The leading economic indicators have been strong for months now and are getting stronger. Mainstream forecasters and commentators have ignored the strength and breadth of this recovery and have instead focussed on lagging indicators, or have become so used to bad news that they are finding it difficult to see the boom coming. The all-sector PMI lead indicators recently reached their strongest level since records began in 1998. The employment lead indicator is also at its high, while construction and investment indicators are soaring. As house prices continue to pick up and companies have huge amounts of cash to spend, rising economic activity is likely next year in a pre-election ‘boomlet’. I do not see much sign of weakness.

Are politics driving economic policy? A recovery starting in 2013 and accelerating into 2014 is good timing politically. Has George Osborne, renowned political strategist, been playing a very clever game? Could the economy have been carefully timed by the Chancellor to align the economic cycle with the electoral cycle? The Chancellor seems to have delivered the traditional UK growth profile via rising consumer borrowing and the housing market –

with Funding For Lending to be followed by Help to Buy. His initial professed desire to rebalance the economy towards exports and investment did not materialise, but the old stalwarts have come to the rescue. The Tories know that housing and debt drive growth short term and, although that is not the best way to achieve a sustainable recovery, it is politically expedient.

Labour wrong-footed on austerity and growth: The economic upturn so far has wrong-footed Labour, who failed to forecast the growth of the economy this year, despite the rising leading indicators. By over-playing the impact of austerity, and by failing to spot the signs of recovery, the Opposition has enabled the Chancellor to restore some of his economic credibility as the economy recovers.

Continued reliance on housing to deliver feel-good factor and growth: Construction sector leading indicators are soaring and, as house prices continue to rise, while the dangers of a housing bubble are ignored.

Source: Markit

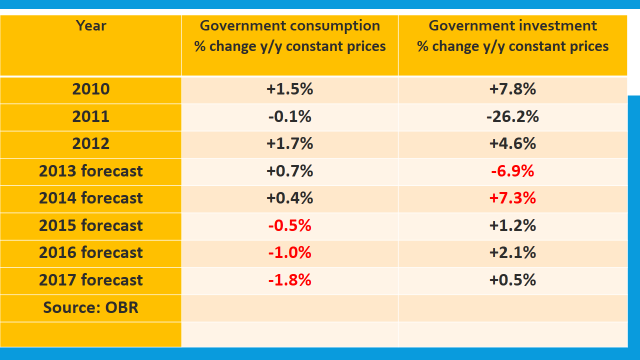

Investment spending set to pick up: The Autumn Statement figures in the table below show a 7.3% rise in Government investment in 2014, after a 6.9% fall in 2013 and a 26.2% cut in 2011. Government consumption shows little austerity so far, which has prevented a steeper downturn. The figures indicate that business investment will rise as economic recovery persists.

Strong downward pressure on inflation to ensure cost of living issues abate:Labour has now changed its attacks on Government policy to focus on the cost of living. It may be that the Chancellor is one step ahead on this one too. Given the strength of growth, one would normally expected a pick-up in the inflation rate, however there are reasons to suggest inflation will turn out much lower than expected. The Chancellor is manipulating the cost of living somewhat, by holding down energy price increases and rail fare rises, keeping a lid on council tax and perhaps other administered prices as well. In addition, there are strong deflationary forces coming from Europe and the 5% trade-weighted rise in sterling will depress price rises. The base effect from this year is also likely to flatter the inflation figures for next year. I am predicting reasonably subdued inflation perhaps even being below the Bank of England’s target at 1.9% in Q1, then the rest of the year remaining around the 2% target level.

Real earnings will rise at last as unemployment falls: During 2014, I forecast average earnings are likely to rise by nearly 3%, with inflation around 2%. Unemployment is also likely to fall towards or even below the 7% level by end-year.

When will interest rates rise – a small rate rise is hardly likely to bring borrowers to their knees: The big question is whether the Bank of England will finally start to increase interest rates back towards more normal levels from the current emergency 0.5% rate which was set to avoid depression. Rates are currently much too low. There are dire warnings that a rise in rates would lead to major problems for borrowers, defaults and repossessions, which would derail the economic recovery. I find those arguments difficult to accept. A small rise in rates from 0.5% is hardly likely to bring borrowers to their knees and would be a welcome sign of the start of a return to normality, giving also a sign of increased economic confidence. Let’s face it, if people could not afford to repay their debts with an increase in base rates from 0.5% to, say, 1%, then surely those debts are going to be defaulted on sooner or later and need to be rescheduled. I am predicting rates will start to rise in the second half of 2014. The continued encouragement of borrowing at such unsustainably low interest rates is setting up dangers for the future. If people cannot afford to repay debts when interest rates rise from 0.5% to, say, 1% then surely those debts are simply unaffordable and will sooner or later default.

Monetary policy missing long-term dangers: Encouraging too much debt caused the crisis in the first place and keeping interest rates too low for too long risks misleading more borrowers into taking on more debt than they should. Unfortunately, however, low rates are popular with policymakers who are frightened of pushing debtors into default. I have significant concerns that monetary policy is continuing to focus far too much on the short-term, while missing the longer term dangers.

Short-term feelgood but repeating past mistakes: Building economic growth on the availability of cheap borrowing, low cost mortgages and rising house prices risks repeating the mistakes that led to the original crisis but, for now, it is likely to be successful in stimulating growth short-term, which is clearly a policy objective.

2014 – a good year for many: If I am right, then 2014 should be a good year for growth as well as for borrowers. It is also likely to be the first year for some time that sees real earnings rising. Of course, the ongoing low interest rates will be yet more bad news for savers, but who cares about them anyway?

Pre-election boom: By accident or by design, it seems the economy has been very conveniently timed to match the electoral cycle.

ENDS

NOTES FOR EDITORS

- This is a link to my presentation at the Clash of the Titans event hosted by the Economic Research Council where I gave my 2014 outlook www.genesysdownload.co.uk/rosaltmann/Clash_of_the_Titans_econ_forecast_2014_Dec_2013.pdf.

- This is a link to the event itself http://www.ercouncil.org/clash-of-the-titans-2013/ which was chaired by Andrew Sentance of PwC, former member of the Bank of England’s Monetary Policy Committee, and pitched three leading economists against each other, predicting the outlook for the year ahead. Kevin Daly of Goldman Sachs represented Cambridge University, Stephen King of HSBC represented Oxford and I represented LSE. We all produced forecasts, with mine being the most bullish.

- Anyone can submit their own predictions between now and December 31st and possibly be in line to win the competition which will be judged next year. You can enter here: http://www.ercouncil.org/cott2013-competition/

- My detailed forecasts: